Key Takeaways

Stock and bond markets had one of the worst performances in recent years, but commodities and value stocks did significantly better compared to the rest of the market.

Lower stock and bond prices may give us an opportunity to earn better returns going forward.

Improving inflation and steady unemployment could lead to a soft landing and avoid deeper recession.

Global economy is expected to slow down again in 2023 while commodity prices should moderate.

Market review

Author: Richard Toth, CFA

The last quarter of 2022 turned out to be one of the better ones that we have seen throughout the year, but even though US stocks returned 7.18%, 2022 closed with a -19.21% loss. International developed stocks and emerging stocks did better past quarter with 16.18% and 9.7% returns respectively, but their overall annual performance was not much different from US as they lost -14.29% and -20.09%. The worst performer of 2022 is undoubtedly real estate which at -24.36% lost almost a quarter of its value in just one year as high interest rates quickly put breaks on the housing market. While bonds are often considered a conservative investment, the rapid pace of the interest rate hikes witnessed last year took its toll on their price as they ended with -13.01% loss in US.

Market Performance [Source: Quarterly Market Review Fourth quarter 2022 by Dimensional Fund Advisors LP]

The bright spot in 2022 hold commodities which returned 16.09%[1] during the calendar year. High commodity prices, mainly in the energy sector, helped Energy stocks to be the only stock sector with positive returns for the investors in 2022 at 35.2%[2]. The worst performing sector of the year was communication services at -34.9% followed by consumer discretionary and technology sectors not too far away at -30.8% each.

While the immediate effect of this bad performance is most visible in the lower balance of our investment accounts, the price drop brings us an opportunity to earn better returns in future. This is most visible in bonds, where for example the 5-year government bonds now yield 3.66%[3] a notable increase from just 1.5% a year ago. This more than 2% increase in annual yields over the 5- year term of bonds will be welcomed to offset a portion of the 2022 losses. Similar thing can be said about stocks where the Cyclically Adjusted PE ratio dropped from the recent peak of 38.58[4] in November of 2021 to just 27.96 on January 1st making the price paid for $1 of companies’ earnings much lower and therefore much more attractive.

Factors

Author: Mark VanderPol, CFP®

Several factors have been discovered over the years that have produced larger returns over time than would have been justified by simply gaging their market exposure. With that in mind, we have created portfolios that emphasize these factors to hopefully provide greater risk adjusted returns.

Factor investing has been a major theme for VanderPol Investments and our portfolios over the years and in 2022 those factors played a major role in returns. The Capital Asset Pricing Model (CAPM) introduced by Sharpe in 1964 created the first and most important factor, diversified market exposure. However, since then there has been an accumulation of evidence that indicates CAPM provides an incomplete description of risk and that models incorporating multiple sources of systematic risk more effectively demonstrate asset returns. At VPI we draw on this evidence to emphasize areas of the market that we believe will improve performance through implementation that has been tested, repeated, and refined. That has led us to emphasize companies that are considered Value, Small, Profitable, Less Liquid and have Momentum.

In 2022, the Value factor provided the greatest benefit with the Russell 3000 Value index returning just a negative 7.98% return compared to the Russell 3000 Growth index returning a negative 28.97% for a spread of 20.99%. This difference can be seen in the graph of factor returns below as the Value factor is rising.

The emphasis on these factors over the years has led to performances we are proud of and happy to review with our clients. We believe that continuing to emphasize these factors will produce similar results over long periods of time.

Value – The value factor describes stocks with higher prospective earnings, book value, revenue, cash flow, and dividends all scaled by the current price of the stock against stocks with high earnings growth, book value growth, revenue growth and cash flow growth.

Momentum – The momentum factor describes how much a stock has risen in price over the past year relative to other stocks, calculated by subtracting the trailing 1-month return from the trailing 12-month return. A higher exposure to the momentum factor indicates the company has performed well recently.

Quality – The quality factor describes the profitability and financial leverage of a company, based on an equally weighted mix of trailing 12-month return on equity and debt-to-capital ratios. A higher exposure to the quality factor indicates a higher quality of the firm.

Liquidity – The liquidity factor describes the trading frequency of a company, based on trailing 30- day share turnover. A higher exposure to the liquidity factor indicates higher share turnover.

Size – The size factor describes the market capitalization of a company, based on the same measure used for the Morningstar Style Box. A higher exposure to the size factor indicates smaller market capitalization.

© 2023 Morningstar. Factor data is not warranted to be accurate, complete or timely. Neither Morningstar, VanderPol Investments nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by low in your jurisdictions. Past financial performance is no guarantee of future results.

US Economy

Author: Richard Toth, CFA

For many of us 2022 was a year when we expected to return to our pre-pandemic lifestyle and finally worry less about our health, personal finance, economy and world in general. As it turned out, this was not that kind of a year and instead we had to deal with the worst inflation in the past 40 years, worries about recession and first major war on a European continent since WW2.

While inflation was still elevated in December at 6.5%[5], there was a significant progress made on getting it under control since the 9.1% peak back in June. One of the early drivers of the inflation, the supply chain disruption is returning to pre-pandemic levels as manufacturing output reached and even surpassed 2020[6], quickly closing the gap between demand and output. Another sign of this can be seen in container shipping costs that are back to $2,000 range, after briefly reaching $10,000[7] levels towards the end of 2021. While other drivers of inflation like energy and commodity prices are down as well, the increasing cost of services and wage growth caused by tight labor market is still present.

The overall economy continues to do well despite the high inflation and the higher borrowing costs that came from one of the fastest interest rate hikes in history. Output of our economy is expected to reach 4.1%[8] for fourth quarter and around 2.0%[9] for full 2022 year. The biggest contributor to this good performance so far were services, vastly outperforming goods, and the government.

Real GDP by Industry [Source: Bureau of Economic Analysis]

A positive trend can be seen in the most recent unemployment numbers where inflation pressure in form of wage growth is slowly cooling off without the often-expected increase in the unemployment. In December, the unemployment rate dropped back to 3.5%[10], the lowest unemployment rate (along with the 1-2/2020 period) since 1969 when it stayed at 3.4% for a couple of months[11].

Hourly earnings and the unemployment rate [Sources: Schwab Asset Management, Bloomberg, Bureau of Labor Statistics, as of 12/31/2022]

Global Economy

Author: Richard Toth, CFA

Since the start of the war in Ukraine last year, Europe’s growth prospect fell sharply as the already growing inflation became much worse mainly due to the disruption of energy flows that increased the price of gas and electricity at one point as much as 15-fold since early 2021[12]. Even though recent inflation numbers came down to 9.2%[13] in December from 10.7%[14] in October, they are still significantly higher than the target. While large portion of these extra costs are so far subsidized by governments, in Germany’s case the subsidies amount more than 7% of its GDP[15], they are already disrupting the overall health of European economy with many of the energy intense industries slashing productions. The GDP growth is expected to slow down to 3.3% in 2022 and 0% in 2023 as projected by World Bank[16].

On the other side of the Pacific Ocean, China, the second largest economy also had a challenging year. From dealing with the aftermaths of housing crisis to being one of the few countries left with strict Covid related restrictions the economic growth fell to just 2.7% from 8.1% in 2021[16]. When protests against the Zero Covid policy swept the country last November, China decided to reopen its economy after almost 3 years of isolation. While this will put pressure on the commodity prices and overall cost of goods and inflation, the boost to the global demand will be welcomed in many parts of the world.

As the countries around the world use their currencies for trade, the rates at which their currency exchange between each other can have a big impact on their economies. Among the major currencies, the US dollar had a great performance in 2022 with peak gains of 18% back in October, closing the year lower but with still impressive 7% gain[17].

What to expect from 2023

Author: Richard Toth, CFA

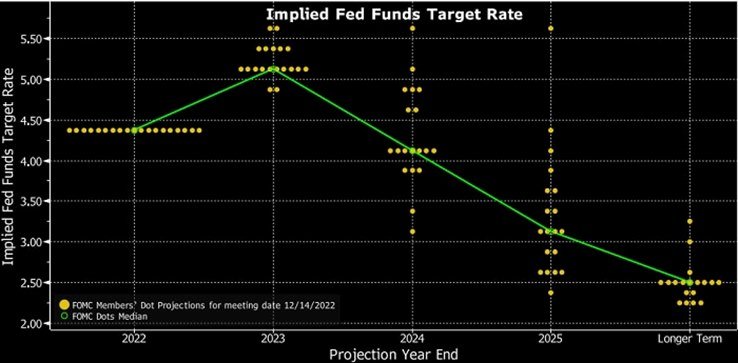

One of the expectations that the market has for 2023 are lower interest rates. While the progress on the inflation front at home was so far great, the inflation expectation and the interest rates that depend on them vary widely between the market (3.4%[18]), the consumers (5%[19]) and ultimately the Fed. Latest data shows that the Fed does not expect to cut interest rates in 2023 contrary to what market thinks will happen. Terminal[20] fed rate expectation is at 5.1% in 2023 after which they will drop to 4.1% in 2024[21]. Market’s expectation is for interest rates to peak as soon as this May before the rate cuts begin later this year[22]. Considering all of this, the latest estimates for US economy are putting growth somewhere between 0.2%[23] according to The Conference Board and 0.8%[24] according to Morningstar in 2023.

Implied Fed Funds Target Rate [Sources: Schwab Asset Management, Bloomberg, as of 12/14/2022]

Global economy is expected to slow down as well with growth expectations ranging from 1.7%[25] to 2.2%[26] in 2023, down from 3.2% in 2022. This growth would be one of the slowest in nearly three decades[27]. Majority of the slowdown is expected to come from advanced economies (US, Euro Area, Japan) while the emerging and developing economies are expected to maintain their 2022 growth levels. The commodity prices are expected to decrease on both energy and non-energy fronts[28] even with the expected increase in the demand from China’s reopening.

2023 Savings

Author: Noah Hoekstra

The combination of improving inflation and low market prices may be a great time for long term investors to put some savings to work. There are many different avenues and vehicles you can use for saving and investing for your future, whether that is after-tax vehicles like Roth IRA’s and Roth 401(k)s, or pre-tax vehicles like Traditional IRA’s, 401(k)’s, or 403(b)’s. Each of these retirement accounts have maximum contribution limits that are important to be aware of. As a result of inflation, the IRS raised the maximum allowable contributions of retirement accounts. Most retirement account limits are cost-of-living adjusted, so as inflation goes up, the limits should go up as well. Maximum allowable contributions into 401(k)’s went from $20,500 in 2022 to $22,500 in 2023. Looking at IRA’s (Roth and Traditional), their maximum allowable contribution increased to $6,500 from $6,000 for individuals under 50.

Source: Internal Revenue Service

There are a few nuances that could be prominent to your situation when thinking about saving into these different accounts, like catch-up contributions and household income. If you would like to see how you are saving, and if these changes could impact you, please give Noah Hoekstra a call at 616-566-6443. He would love to go over the opportunities that present themselves to you in 2023 to save more and build for the future.

Work cited

[1] Represented by The Bloomberg Commodity Total Return Index [ Quarterly Market Review fourth Quarter by Dimensional Fund Advisors LP]

[2] Global Energy Sector return [Source: Market in Review: 2022 by Dimensional Fund Advisors LP]

[3] U.S Treasury Yield Curve Rate for a 5-year maturity as of 1/09/2023 [Source: Morningstar]

[4] US stock market represented by S&P500 [Source: https://www.multpl.com/shiller-pe/table/by- month]

[5] Source: U.S. BUREAU OF LABOR STATISTICS

[6] Source: https://www.carlyle.com/sites/default/files/2023-01/Carlyle-Five-Questions-2023.pdf

[7] Source: https://www.carlyle.com/sites/default/files/2023-01/Carlyle-Five-Questions-2023.pdf

[8] Measured by Real GDP growth [Source: https://www.atlantafed.org/cqer/research/gdpnow]

[9] Source: U.S. Economic Pulse: December 2022 by Morningstar

[10] Source: https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm#

[11] Source: https://fred.stlouisfed.org/series/UNRATE

[12] Source: https://www.imf.org/en/Publications/fandd/issues/2022/12/beating-the-european- energy-crisis-Zettelmeyer

[13] Eurozone inflation [Source: https://ec.europa.eu/eurostat/statistics-explained/index.php? title=Inflation_in_the_euro_area]

[14] Souce: https://int.nyt.com/data/documenttools/eurozone-inflation-data- october-2022/499dee58f6bea34c/full.pdf

[15] Source: https://www.carlyle.com/sites/default/files/2023-01/Carlyle-Five-Questions-2023.pdf

[16] Source: https://openknowledge.worldbank.org/bitstream/handle/10986/38030/GEP- January-2023.pdf

[17] US dollar represented by U.S. Dollar Index (DXY) [Source: https://www.wsj.com/market-data/ quotes/index/DXY]

[18] Inflation (Personal Consumption Expenditures) Consensus forecast [Source: U.S. Economic Pulse: December 2022 by Morningstar]

[19] Median one-year-ahead inflation expectations as of 12/2022 [Source: https:// www.newyorkfed.org/microeconomics/sce#/inflexp-2]

[20] Terminal rate is defined as the peak spot where the benchmark interest rate will come to rest [Source: https://www.marketwatch.com/story/its-natural-for-everyday-investors-to-wonder-when- these-interest-rate-increases-will-stop-the-terminal-rate-the-peak-of-this-rate-cycle-may-still-be-far- off-11658957418]

[21] Source: https://www.schwab.com/learn/story/fomc-meeting

[22] Source: https://www.schwab.com/learn/story/market-perspective

[23] Source: https://www.conference-board.org/research/us-forecast

[24] Source: U.S. Economic Pulse: December 2022 by Morningstar

[25] Source: https://openknowledge.worldbank.org/bitstream/handle/10986/38030/GEP- January-2023.pdf

[26] Source: https://www.conference-board.org/topics/global-economic-outlook

[27] Source: https://openknowledge.worldbank.org/bitstream/handle/10986/38030/GEP- January-2023.pdf

[28] Source: https://openknowledge.worldbank.org/bitstream/handle/10986/38030/GEP- January-2023.pdf

Disclosures

VanderPol Investments, LLC (“VPI”) is a registered investment adviser located in Michigan. VPI may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This presentation is limited to the dissemination of general information regarding VPI’s investment advisory services. Accordingly, the information in this presentation should not be construed, in any manner whatsoever, as a substitute for personalized individual advice from VPI. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Any client examples were hypothetical and used to demonstrate a concept.

Past performance is not indicative of future performance. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by VPI), or product referenced directly or indirectly in this presentation, will be profitable. Different types of investments involve varying degrees of risk, & there can be no assurance that any specific investment or investment strategy will suitable for a client’s or prospective client’s investment portfolio.

Various indexes were chosen that are generally recognized as indicators or representation of the stock market in general. Indices are typically not available for direct investment, are unmanaged and do not include fees or expenses. Some indices may also not reflect reinvestment of dividends.

VPI may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.

© 2023 Morningstar. Factor data is not warranted to be accurate, complete or timely. Neither Morningstar, VanderPol Investments nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by low in your jurisdictions. Past financial performance is no guarantee of future results.