Key Takeaways

Markets swiftly recovered from historic volatility, ending the quarter on a high note despite recession fears and global rate changes.

Real estate soared with a 16% gain, leading the charge as emerging markets and utilities also showed impressive performance.

A strategic rate cut by the Fed in September revitalized bonds and reshaped the yield curve, setting the stage for post-election market stability.

Market review

After a strong end to the second quarter and reaching a new record high in mid-July, market volatility returned with fears of a recession in the US and an interest rate hike in Japan. On August 5th, the volatility index (VIX) surged by 42 points to 65[1], marking the largest ever intraday jump. That same day, the S&P 500 lost 4.2%[2], the Japanese index Nikkei fell 12%[3], and Bitcoin dropped 17%[4]. However, markets recovered relatively quickly, and all asset classes, with the exception of cryptocurrencies, closed the quarter with positive returns. While election-related uncertainty will remain with us until the elections is over next month, we expect the VIX to stabilize post-election as executives gain more clarity on sector-specific outlooks and make capital expenditures accordingly. In line with market expectations, the Fed lowered rates by 0.5% in September to close out the quarter.

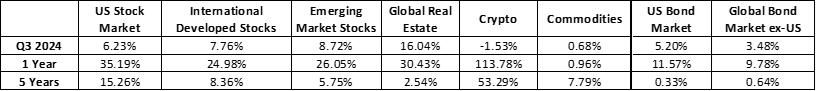

The best-performing sector was Real Estate, which rose by 16%, followed by emerging market stocks at 8.7% and developed markets at 7.7%[5]. US stocks weren't far behind, adding 6% to their already strong performance earlier in the year[6]. Within the US, real estate and utilities were the standout sectors, with gains of 17% and 19%, respectively[7]. With lower interest rates, real estate valuations and activity are expected to get a boost. Interestingly, utilities returned a solid 19%, driven by excitement around AI and its anticipated impact on electricity demand. This increased demand is expected to inject life into what has traditionally been a stable, low-growth sector.

The third quarter also saw significant sector rotation, with small caps outperforming large caps, and value stocks outpacing growth stocks. Small-cap value stocks gained 10%, while large-cap growth stocks rose by only 3%[8]. With interest rates expected to decline and the economy remaining resilient, the rotation into smaller companies is likely to persist, albeit with some volatility along the way.

Market Performance [Source: Quarterly Market Review – Third Quarter 2024 by Dimensional Fund Advisors] [9]

While all investments performed well this quarter, the Schwab Short-Term U.S. Treasury ETF (SCHO) stood out with an unusually high performance of 2.89%[10], particularly when compared to its historical average of 0.44%[11]. With an average duration of just 1.9 years, this fund invests in treasuries with maturities between 1 and 3 years and is therefore highly sensitive to Federal Reserve policy. The unusually high return for the fund used in conservative portfolios reflects the sharp drop in bond yields during the quarter, as growing expectations of lower interest rates pushed SCHO’s price significantly beyond its typical range. This is a rare occurrence, as the Z-score of above 2 indicates, meaning SCHO's return was more than two standard deviations above its typical performance.

Market Yield on U.S. Treasury Securities at 2-Year Constant Maturity by Board of Governors of the Federal Reserve System [Source: https://fred.stlouisfed.org/series/DGS2]

Globally, several rate cuts contributed to strong bond market performance. In the US, the bond market returned 5.2% while ex-US bonds returned 3.48%[12]. As a result of the rate cut in US, the yield on the 10-year Treasury fell to 3.81%, while the 1-year yield dropped to 3.98%[13]. The narrowing of yields, especially on the short end, caused the spread between the 2-year and 10-year Treasuries to un-invert for the first time since 2022[14]. The inverted yield curve had been signaling economic uncertainty, especially during intense rate hikes aimed at fighting inflation. This situation resulted in unusual market environment, with higher returns on cash than long-term bonds. With the yield curve now normalizing, long-term investors may once again be rewarded for holding onto longer-duration assets.

A major development in Q3 was the launch of another spot-based cryptocurrency ETF, this time for Ethereum. Following the successful launch of the Bitcoin ETF in January, both individual and institutional investors now have easier access to Ethereum. While Bitcoin and Ethereum differ in their specific functions and use cases, both are built on innovative technology with the potential to reshape the future of finance. Bitcoin, often referred to as "digital gold," is a decentralized currency that uses blockchain technology to ensure transparency and security without the need for a central authority. Ethereum, meanwhile, is a decentralized platform that supports smart contracts and decentralized applications (dApps), with its native currency, Ether (ETH), playing a vital role in powering innovations in decentralized finance (DeFi) and other blockchain-based solutions. As these new technologies become more mainstream and gain global investor confidence, we anticipate they will outperform traditional equities over the long term.

Economy

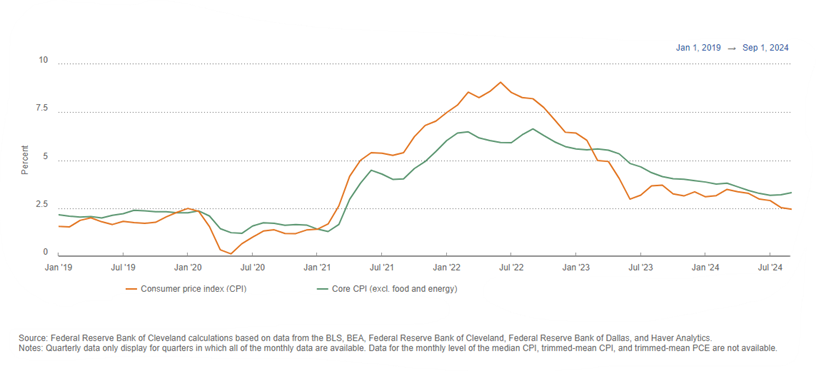

When the Fed began raising interest rates in 2022, it took them 16 months to reach a level they deemed sufficiently high to cool down the inflation. Now, 14 months after the last hike in 2023, we have seen the first rate cut of this cycle, a moment eagerly anticipated by many investors. With a 0.5% reduction, the new target range for the federal funds rate is 4.75-5%[15]. The Fed is aiming to recalibrate its monetary policy to address moderating inflation and growing concerns about a weakening labor market. In line with its dual mandate of maintaining both price stability and full employment, the Fed now faces more balanced risks between these two objectives.

Chart by Federal Reserve Bank of Cleveland [https://www.clevelandfed.org/center-for-inflation-research/inflation-charting]

In September, overall inflation improved again, reaching 2.4%, which is even lower than the 2.5% inflation seen in January 2020[16], just before the onset of COVID-19. While the headline numbers look promising, inflationary pressures remain elevated in certain areas, particularly within the services sector. Services excluding energy saw a 4.7%[17] year-over-year increase, while average hourly earnings of employees rose by 4%[18].

The significant labor market cooldown observed earlier this year appears to have eased for now, with recent improvements in both unemployment and job creation. The unemployment rate fell to 4.1% after briefly spiking to 4.3%[19] in July, and nonfarm payroll employment increased by 254,000, recovering from a low of 108,000[20] in April. As interest rates decrease, the labor market is expected to stabilize, helping to prevent further deterioration and supporting a healthier economic environment.

GDP one of the best measures of economic growth, accelerated in the second quarter to 3%[21], up from 1.6% in Q1. The increase in real GDP was driven by higher consumer spending, private inventory investment, and nonresidential fixed investment. Notably, private goods-producing industries grew by 6.9%, with key contributions from manufacturing, while services-producing industries increased by 2.4%, led by finance, health care, and real estate[22]. Government growth was the smallest, rising just 0.8%. Looking ahead, current predictions for the third quarter estimate growth at 3.2%[23], signaling continued strong performance.

As the 2024 election approaches, both major candidates are proposing fiscal policies that would further increase the U.S. national debt, regardless of the outcome. According to the Committee for a Responsible Federal Budget, both President Trump and Vice President Harris’s plans would likely add trillions to the deficit over the next decade, exacerbating an already significant debt burden[24]. Currently, federal debt is projected to rise from 99% of GDP in 2024 to over 122% by 2034[25], driven by growing interest payments and structural deficits. Although these fiscal challenges are concerning, markets historically have shown resilience to changes in presidential administrations. Broad economic trends such as inflation, interest rates, and corporate earnings tend to drive market performance more than specific election outcomes. As a result, while the election will shape fiscal policy, it is unlikely to have a dramatic impact on short-term market behavior.

The strong economic performance in the US contrasts with ongoing challenges in the world’s second-largest economy, China. With its property market in a downturn since peaking in 2021, the sector is heavily weighing on the overall economy, as consumers, concerned about the future, are hesitant to spend. After several modest stimulus packages following the pandemic, China's central bank unveiled its largest package yet in September, including rate cuts and new funding initiatives[26]. Meanwhile, in Japan, the world’s third-largest economy, the central bank took the opposite approach, raising interest rates to around 0.25%[27]—the highest since 2008—in an effort to control rising inflation.

What’s next

As summer winds down and kids head back to school, the Detroit Tigers are making a surprise run into the playoffs. At the same time, the upcoming elections may add to the sense of uncertainty, making us feel uneasy about the future. However, it’s crucial to remember that markets are a long-term journey, and staying committed to your plan is key during times of volatility. If you’re feeling unsure about your investments, we're here to support you. Together, we can navigate these challenges and keep your financial goals in sight.

Author: Richard Toth, CFA, CAIA

References

[1] Source: https://www.reuters.com/markets/us/wall-street-fear-gauge-posts-record-intraday-jump-stocks-slide-2024-08-05/

[2] Price change at open [Source: https://www.cnbc.com/2024/08/04/stock-market-today-live-updates.html]

[3] Based on Nikkei 225 Index closing price on 8/5/2024

[4] Bloomberg Galaxy Crypto Index [Source: https://www.forbes.com/sites/greatspeculations/2024/08/12/global-markets-reacts-to-the-japanese-yen-carry-trade-unwind/]

[5-6] Source: Quarterly Market Review – Third Quarter 2024 by Dimensional Fund Advisors

[7] Sectors listed are S&P 500 sector indexes [Source: Charles Schwab -Quarterly ChartBook Q4 2024]

[8] Source: Quarterly Market Review – Third Quarter 2024 by Dimensional Fund Advisors

[9] US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]),Global Real Estate (S&P Global REIT Index [net dividends]), Commodities (The Bloomberg Commodity Total Return Index), US Bond Market (Bloomberg US Aggregate Bond Index), Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]), Crypto (S&P Cryptocurrency MegaCap Index)

[10] Source: Morningstar Office

[11] Based on quarterly averages since 2017/03

[12-13] Source: Quarterly Market Review – Third Quarter 2024 by Dimensional Fund Advisors

[14] Source: Quarterly Chartbook Q4 2024 by Charles Schwab

[15] Source: Board of Governors of the Federal Reserve System

[16] Source: Federal Reserve Bank of Cleveland

[17-20] Source: U.S. Bureau of Labor Statistics

[21-22] Source: U.S. Bureau of Economic Analysis

[23] Federal Reserve Bank of Atlanta’s GDPNow as of 10/09/2024

[24] Source: Committee for a Responsible Federal Budget [https://www.crfb.org/papers/fiscal-impact-harris-and-trump-campaign-plans]

[25] Source: Congressional Budget Office [https://www.cbo.gov/system/files/2024-06/60039-Outlook-2024.pdf]

[26] Source: https://www.reuters.com/world/china/china-unveils-broad-stimulus-measures-revive-economy-2024-09-24/

[27] Source: https://www.cnbc.com/2024/07/31/boj-raises-benchmark-interest-rate-outlines-roadmap-for-trimming-bond-buying-program.html

Disclosures

VanderPol Investments, LLC (“VPI”) is a registered investment adviser located in Michigan. VPI may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This presentation is limited to the dissemination of general information regarding VPI’s investment advisory services. Accordingly, the information in this presentation should not be construed, in any manner whatsoever, as a substitute for personalized individual advice from VPI. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Any client examples were hypothetical and used to demonstrate a concept.

Past performance is not indicative of future performance. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by VPI), or product referenced directly or indirectly in this presentation, will be profitable. Different types of investments involve varying degrees of risk, & there can be no assurance that any specific investment or investment strategy will suitable for a client’s or prospective client’s investment portfolio.

Various indexes were chosen that are generally recognized as indicators or representation of the stock market in general. Indices are typically not available for direct investment, are unmanaged and do not include fees or expenses. Some indices may also not reflect reinvestment of dividends.

VPI may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.