Key Takeaways

Equity markets erased some of the gains but are still up year-to-date.

International developed markets took back their 1-year performance lead from the US.

Fixed income performance was negative, with yields reaching their highest level since 2007.

The economy steamed ahead, but 2024 predictions are cautious.

Labor market remained strong with unemployment at 3.8%.

Market review

Good performance from the first half of 2023 did not carry over into the third quarter, and as the summer was kicking in, the stock market (which also took a summer break) erased some of the earlier gains. The market peaked in July at +20%[1] and since then dropped to +12% YTD[2]. With negative performance and sentiment, the volatility came back as well. Volatility indicator VIX increased 29% during the Q3 compared to the decrease of -27% in Q2[3]. At current VIX levels between 17 - 20 we are still experiencing moderate volatility, but if the trend continues, we will be approaching levels indicating a growing concern in market.

Market Performance [Source: Quarterly Market Review - Third Quarter 2023 by Dimensional Fund Advisors] [4]

The third quarter of 2023 turned out to be a bad one for stocks, as the US market lost -3.25% after generating 7% and 8% in Q1 and Q2, respectively. International developed markets lost even more at -4.1%[5] while the emerging markets performed a bit better at -2.93%. Looking closer at the drivers of performance in the US, smaller companies performed worse compared to some of the largest and more well know companies. The value factor did better within smaller companies and outperformed the growth, while the larger growth companies did better than their value counterparts[6]. The best performing country of this quarter was Turkey, with almost 40% return while the worst returns saw Netherlands with more than 10% loss[7].

As stocks, real estate and bonds lost up to 6%, the commodities were the only bright spot with +4.71% return. The increase in oil prices that led to this good performance is not great news for many of the consumers that regularly stop at gas stations, or the Fed that closely watches inflation data. From VPI’s holdings, the commodity focused abrdn Bloomberg All Commodity Longer Dated ETF (BCD) was also the best performer with 3.45% gain[8]. VPI’s choice to get exposure trough longer dated commodity futures was not beneficial during this quarter as it lagged by 1.26%, but when looking at its longer term one-year performance, BCD outperformed by 1.42%. With longer-dated futures, investors are less exposed to (roll returns from) often larger price differences at the front-end of the forward curves and rely more on the longer-term price movements of the forward curve’s back end.

Retail Gasoline Prices per Gallon [Source: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0_pte_nus_dpg&f=m]

With the -3.23% losses in the US bond market, the worst performer among VPIs securities was our longer dated treasury fund Vanguard Extended Duration Treasury ETF (EDV) with -18.89% loss[9]. Investing in longer dated treasuries has great value when there is actual economic downturn, and the interest rates needs to be lowered to support struggling economy. However, at times like this when the interest rates keep going up, the longer duration makes even a small increase in interest rates hurt. With the recent selloff in bonds, the returns offered are becoming very attractive as they have not been this high since 2007. The current yields are a great predictor of future returns[10] and looking at short-term treasuries, buying one year bond at the end of last quarter would yield 5.46%[11] if held to maturity, and 10-year US Treasury would generate 4.59% YTM[12]. Treasuries often used as proxy for risk free rate, serve as a floor from which required return on a more risky investments is calculated. With yields this high, we are expecting all other areas of the investing to return more than 5%.

10 Year Treasury Rate [Source: https://www.cnbc.com/quotes/US10Y

Economy

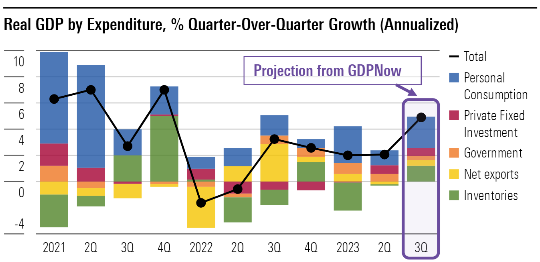

Even though the stock market did not have its best quarter and the inflation jumped back to 3.7%[13] in September, the actual economy was doing really good. The latest estimate for 3rd quarter GDP is at 5.4%[14] annual growth rate, the best since Q4 of 2021 (7%)[15] and a notable improvement from 2.1% annualized in Q2 2023[16]. Looking at the individual contributors, we can see in the chart below created by Morningstar, that the Personal Consumption led the growth, followed by Inventories. Labor market stayed strong too with overall unemployment rate at 3.8%[17] and added healthy 266 [18] thousand new jobs each month on average in Q3 compared to 201 thousand in Q2 and 312 thousand in Q1[19] .

Real GDP by Expenditure by Morningstar [Source: Economic Pulse: U.S. Economy September 2023]

Unfortunately, the high growth rate of Q3 is not something that many economists expect to be repeated in the coming quarters. The leading economic index LEI® fell each month consecutively since April 2022[20], and The Conference Board expects growth to reach only 0.8%[21] in 2024. The Federal reserve raised rates in July to 5.25-5.5%[22] range and kept them unchanged in September, the first meeting with no hike since January 2022. As the lagged effect of tight monetary policy with high interest rates might be finally catching up, the question is whether the fiscal policy of the federal government will become more restrictive too. As we can see on the chart below from Vanguard’s[23] research, the policies are going the opposite direction in 2023, neutralizing each other to some degree.

Fiscal vs Monetary policy by Vanguard [Source: https://advisors.vanguard.com/insights/article/series/market-perspectives#united-states]

Uncertainty is unavoidable, have a plan

Q3 of 2023 will be remembered as a volatile and negative quarter based on market returns. Whether we should attribute that to the credit downgrade of the USA by Fitch, fear of government shutdown, or the FED’s interest rate increases, this quarter was not pleasant. On a positive note, the US economy growth estimate for 3rd quarter GDP is at 5.4% annual rate. It is a guarantee that uncertainty is unavoidable, however, having a well-constructed financial plan helps in this unpredictable climate. If you would like to discuss your long-term strategies and specific portfolio construction, please don’t hesitate to reach out.

Authors: Noah Hoekstra and Richard Toth, CFA, CAIA

References

[1-2] Represented by Russell 3000 Index [Source: https://ycharts.com/indices/%5ERUATR]

[3] VPI’s calculation based on VIX price [Source: https://www.google.com/finance/quote/VIX:INDEXCBOE]

[4] US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]),Global Real Estate (S&P Global REIT Index [net dividends]), Commodities (The Bloomberg Commodity Total Return Index), US Bond Market (Bloomberg US Aggregate Bond Index), Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD])

[5-7] Source: Quarterly Market Review – Third Quarter 2023 by Dimensional Fund Advisors

[8-9] Source: Morningstar

[10] If held directly and held to maturity. Investments through bond funds are exposed to other risks that can affect performance.

[11-12] Source: Quarterly Market Review – Third Quarter 2023 by Dimensional Fund Advisors

[13] Source: U.S. BUREAU OF LABOR STATISTICS

[14] Source: Federal Reserve Bank of Atlanta’s GDPNow as of 10/18/2023

[15-16] Source: https://www.bea.gov/sites/default/files/2023-09/gdp2q23_3rd.pdf

[17] Source: U.S. BUREAU OF LABOR STATISTICS

[18-19] VPI’s calculation based on data from U.S. BUREAU OF LABOR STATISTICS

[20] Source: https://www.conference-board.org/topics/us-leading-indicators

[21] Source: https://www.conference-board.org/research/us-forecast

[22] Source: https://www.federalreserve.gov/monetarypolicy/openmarket.htm

[23] Source: https://advisors.vanguard.com/insights/article/series/market-perspectives#united-states

Disclosures

VanderPol Investments, LLC (“VPI”) is a registered investment adviser located in Michigan. VPI may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This presentation is limited to the dissemination of general information regarding VPI’s investment advisory services. Accordingly, the information in this presentation should not be construed, in any manner whatsoever, as a substitute for personalized individual advice from VPI. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Any client examples were hypothetical and used to demonstrate a concept.

Past performance is not indicative of future performance. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by VPI), or product referenced directly or indirectly in this presentation, will be profitable. Different types of investments involve varying degrees of risk, & there can be no assurance that any specific investment or investment strategy will suitable for a client’s or prospective client’s investment portfolio.

Various indexes were chosen that are generally recognized as indicators or representation of the stock market in general. Indices are typically not available for direct investment, are unmanaged and do not include fees or expenses. Some indices may also not reflect reinvestment of dividends.

VPI may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.